Mindset Mentor Series: 5 of our Favorite Reads in Financial Education

Core Strategies from Pioneers in Personal Finance

Welcome back to our Mindset Mentors Series! If you’re new here, this is a series where we like to chat about our favorite books and key lessons in the world of financial education, technology, self-help, entrepreneurship, and investing!

Today, we’re diving into the world of financial education with a list of must-read books from our favorite authors. You may be familiar with some of them, either way, we’ve designed this article to be quick and digestible so even if you’ve read the books before, hopefully you’ll find some of our key takeaways and lessons we’ve highlighted to be a useful reminder!

As always, I encourage you to share your thoughts and recommendations in the comments!

Book 1: “The Total Money Makeover” by Dave Ramsey

Dave Ramsey’s “The Total Money Makeover” is a game-changer for anyone looking to get their finances in shape. Through a series of easy to follow steps, Ramsey guides readers through the process of financial education and improving financial fitness, emphasizing debt elimination and the power of budgeting.

Ramsey always takes the side of debt being bad and something that should be eliminated at all costs. While we agree with Ramsey’s direction and this will work well for most people, it is important to note that this is just one solution and opinion.

Key Lessons & Takeaways

- Create a budget and stick to it for financial discipline.

- Use the “debt snowball” method to eliminate debts quickly.

- Establish an emergency fund to avoid future debts.

- Focus on buying necessities, not luxuries, especially when in debt.

- Investing starts only after achieving financial stability.

Book 2: “The Intelligent Investor” by Benjamin Graham

Benjamin Graham’s “The Intelligent Investor” is a timeless masterpiece in the world of investing. It’s the definitive guide to value investing, emphasizing long-term strategies over short-term gains, and is a must-read for anyone looking to navigate the stock market wisely.

Key Lessons & Takeaways

- The concept of “Mr. Market” and emotional discipline in investing.

- Importance of the margin of safety in stock selection.

- Diversification as a tool to manage risk.

- Long-term investment strategies trump short-term speculation.

- The investor’s mindset: patient, disciplined, and eager to learn.

Book 3: “Your Money or Your Life” by Vicki Robin and Joe Dominguez

This transformative book offers a holistic approach to money management, aligning personal finance with one’s values and life goals. Robin and Dominguez provide a blueprint for financial independence and a meaningful life.

Key Lessons & Takeaways

- Money is a tool for achieving life goals, not just a means to an end.

- The importance of saving and investing for financial independence.

- Track all expenses to understand your financial habits.

- Redefine your relationship with money to focus on fulfillment.

- Achieving financial independence means having more life choices.

Book 4: “Rich Dad’s CASHFLOW Quadrant” by Robert T. Kiyosaki

Kiyosaki’s sequel to “Rich Dad Poor Dad” delves into the four ways of making money: as an employee, self-employed, business owner, or investor. It’s an insightful read for anyone looking to transition from earning a salary to building wealth.

Key Lessons & Takeaways

- Understand the differences between the four income quadrants.

- The importance of financial education in wealth-building.

- Moving from an employee mindset to an investor mindset.

- Creating passive income streams for financial freedom.

- The power of leveraging other people’s time and money.

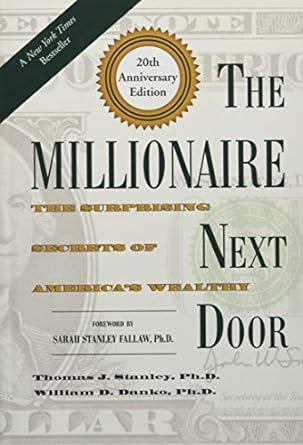

Book 5: “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

This book debunks the myths about millionaires with surprising research findings. It reveals that millionaires are often frugal, hard-working, and smart with their money, offering a realistic roadmap to accumulating wealth.

Key Lessons & Takeaways

- Most millionaires live below their means.

- Wealth accumulation is often the result of hard work, perseverance, and planning.

- Financial independence trumps displaying high social status.

- The importance of teaching your children about financial responsibility.

- Investing wisely and avoiding consumer debt are keys to wealth building.

Conclusion

While these were just a few of our favorites that we chose to feature this week, there are endless resources and amazing books by some incredibly talented authors to check out.

They teach us to be disciplined, informed, and thoughtful with our financial decisions.

“The Total Money Makeover” arms you with the tools to break free from debt, while “The Intelligent Investor” guides you through the complexities of investing with a steady hand. “Your Money or Your Life” redefines the role of money in your life, and “Rich Dad’s CASHFLOW Quadrant” opens the door to financial freedom through smarter income strategies.

Lastly, “The Millionaire Next Door” offers a realistic perspective on wealth accumulation.

These books aren’t just about managing money; they’re about transforming your life through financial literacy.

By applying these lessons, you can build a stronger, more secure financial future and live a life aligned with your values and goals.

Remember, the path to financial mastery is a journey, not a destination. Keep learning, keep growing, and let’s all strive to be a little better each day.

Share your favorite financial education books in the comments, and let’s continue this conversation!

Let us know what books you’d like to see added to our future lists!

Love what we have to say?

Please give us those 👏claps👏 and subscribe for more :)