How to Use ChatGPT to Learn Data-Driven Investing?

These days everyone is using ChatGPT.

Some people to draft emails.

Others to create images.

But what about to use it for investing?

Dara Driven Investing.

How to start?

I will explain it to you.

But first, what is data driven investing?

Understanding Data-Driven Investing

Data-driven investing refers to the use of statistical, algorithmic, and analytical techniques to make investment decisions.

By analyzing vast amounts of data, investors can identify patterns, trends, and signals that guide them in selecting stocks, timing the market, and managing risk.

This approach contrasts with traditional methods that often rely on fundamental analysis or intuition.

Introducing ChatGPT

I have written multiple articles about it but in a nutshell, ChatGPT, developed by OpenAI, is a powerful language model that can understand and generate human-like text based on the input it receives.

Its capabilities include answering questions, providing explanations, and even writing code, making it an invaluable resource for learning complex subjects such as data-driven investing.

Starting with the Basics

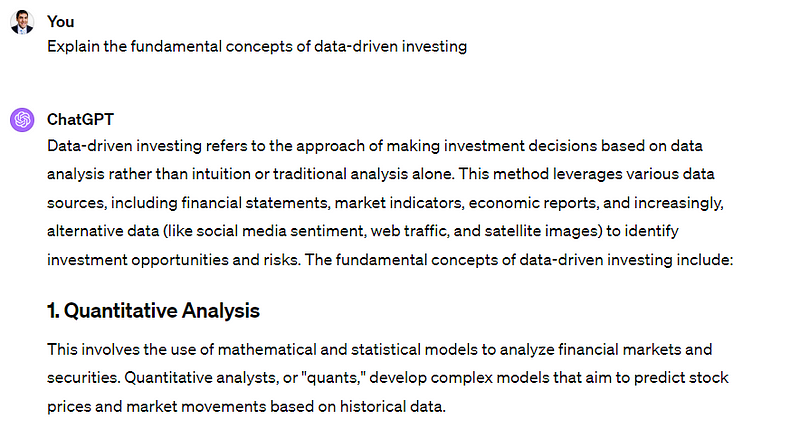

Begin your journey by asking ChatGPT to explain the fundamental concepts of data-driven investing.

This will be the full answer:

“Data-driven investing refers to the approach of making investment decisions based on data analysis rather than intuition or traditional analysis alone. This method leverages various data sources, including financial statements, market indicators, economic reports, and increasingly, alternative data (like social media sentiment, web traffic, and satellite images) to identify investment opportunities and risks. The fundamental concepts of data-driven investing include:

1. Quantitative Analysis

This involves the use of mathematical and statistical models to analyze financial markets and securities. Quantitative analysts, or “quants,” develop complex models that aim to predict stock prices and market movements based on historical data.

2. Big Data

Data-driven investing relies heavily on big data analytics, which involves examining large and varied data sets — or big data — to uncover hidden patterns, correlations, and other insights. With today’s technology, investors can process vast amounts of information to make informed decisions.

3. Machine Learning and Artificial Intelligence (AI)

Machine learning, a subset of AI, allows computers to learn from and interpret data without explicit programming. In investing, machine learning models can adapt to new data and improve over time, providing forecasts and insights based on historical and real-time data.

4. Alternative Data

Beyond traditional financial metrics and economic indicators, data-driven investing often incorporates alternative data sources. This can include satellite imagery to count cars in a retailer’s parking lot, sentiment analysis of news articles and social media, web traffic data, and much more. These data can provide early insights into a company’s performance ahead of official reports.

5. Algorithmic Trading

This involves using algorithms to make trades at speeds and frequencies that are impossible for human traders. Algorithms can execute trades based on specified criteria, such as price, volume, or timing, and can be based on predictive models developed through data analysis.

6. Risk Management

Data-driven investing also applies to risk management, using data analysis to identify, assess, and prioritize risks. Quantitative models can help investors understand correlations between different assets, predict volatility, and optimize portfolios to balance risk and return.

7. Backtesting

Before applying a strategy in the real market, investors use backtesting, which involves simulating how a strategy would have performed in the past. This process uses historical data to evaluate the feasibility and potential success of investment strategies.”

But don’t stop here.

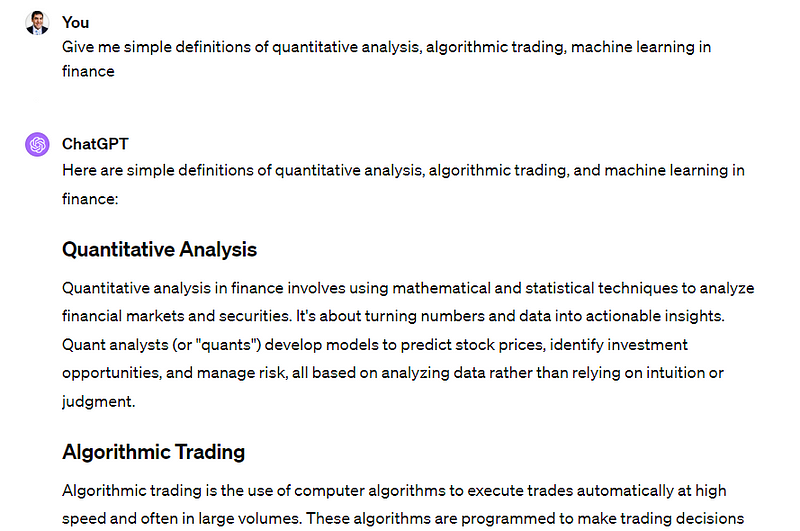

You can also request simple definitions of quantitative analysis, algorithmic trading, machine learning in finance, and any other term that seems unfamiliar.

ChatGPT’s ability to break down complex ideas into digestible explanations makes it an ideal starting point for beginners.

Dive Deeper with Advanced Topics

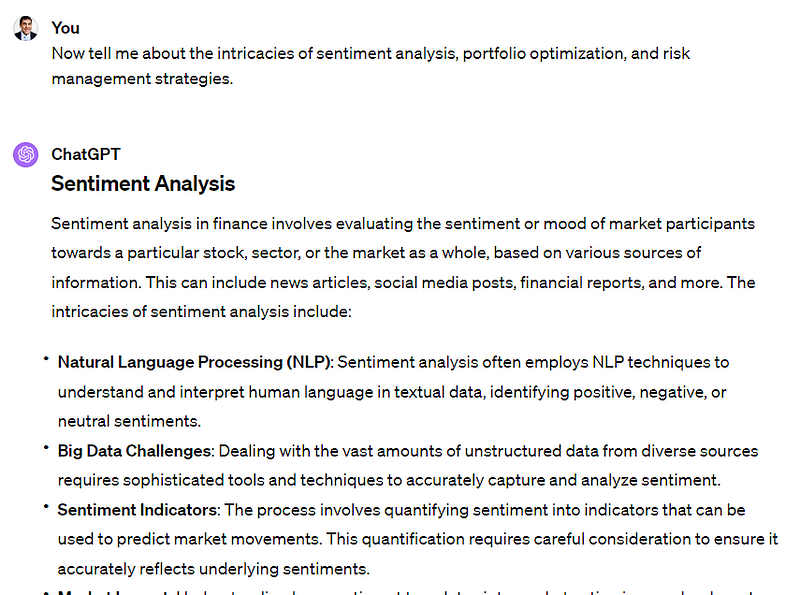

Once you’ve grasped the basics, challenge yourself with more advanced topics.

Inquire about the intricacies of sentiment analysis, portfolio optimization, and risk management strategies.

This will be the output:

Sentiment Analysis

Sentiment analysis in finance involves evaluating the sentiment or mood of market participants towards a particular stock, sector, or the market as a whole, based on various sources of information. This can include news articles, social media posts, financial reports, and more. The intricacies of sentiment analysis include:

- Natural Language Processing (NLP): Sentiment analysis often employs NLP techniques to understand and interpret human language in textual data, identifying positive, negative, or neutral sentiments.

- Big Data Challenges: Dealing with the vast amounts of unstructured data from diverse sources requires sophisticated tools and techniques to accurately capture and analyze sentiment.

- Sentiment Indicators: The process involves quantifying sentiment into indicators that can be used to predict market movements. This quantification requires careful consideration to ensure it accurately reflects underlying sentiments.

- Market Impact: Understanding how sentiment translates into market action is complex. Investor sentiment can sometimes be a leading indicator of market direction, but it can also be misleading, particularly in volatile or irrational markets.

Portfolio Optimization

Portfolio optimization is the process of selecting the best portfolio (asset distribution) out of the set of all portfolios being considered, according to some objective. The objective typically maximizes factors like expected return and minimizes costs like financial risk. Intricacies include:

- Efficient Frontier: A concept in portfolio theory where optimal portfolios offer the highest expected return for a given level of risk or the lowest risk for a given level of expected return.

- Risk Measures: Understanding different risk measures (such as volatility, Value at Risk (VaR), and Conditional Value at Risk (CVaR)) is crucial for optimizing a portfolio in alignment with an investor’s risk appetite.

- Constraints: Real-world constraints (like budget, liquidity, legal restrictions, and specific goals) must be factored into the optimization process, complicating the mathematical models.

- Model Assumptions: The assumptions behind models, such as the Markowitz model, can sometimes oversimplify reality. Factors like changing market conditions, transaction costs, and taxes can impact the effectiveness of optimized portfolios.

Risk Management Strategies

Risk management in finance is the process of identifying, analyzing, and accepting or mitigating uncertainty in investment decisions. Effective risk management strategies involve:

- Diversification: Spreading investments across various financial instruments, industries, and other categories to reduce exposure to any single asset or risk.

- Hedging: Using financial instruments, like options and futures, to offset potential losses in investments, essentially providing insurance against adverse price movements.

- Stress Testing and Scenario Analysis: Evaluating how portfolios would perform under extreme market conditions or specific scenarios to understand potential risks.

- Risk Measures and Limits: Implementing risk measures (e.g., VaR, CVaR) to quantify potential losses and setting limits to contain losses within acceptable thresholds.

- Liquidity Management: Ensuring there is enough liquidity to meet short-term obligations and to mitigate the cost of liquidating positions in adverse conditions.

ChatGPT can provide detailed insights into these subjects, offer examples, and explain how they’re applied in the real world of investing.

Learning through Interaction

One of the unique advantages of ChatGPT is its interactive nature. You can ask follow-up questions, request clarifications, or even ask for practical examples.

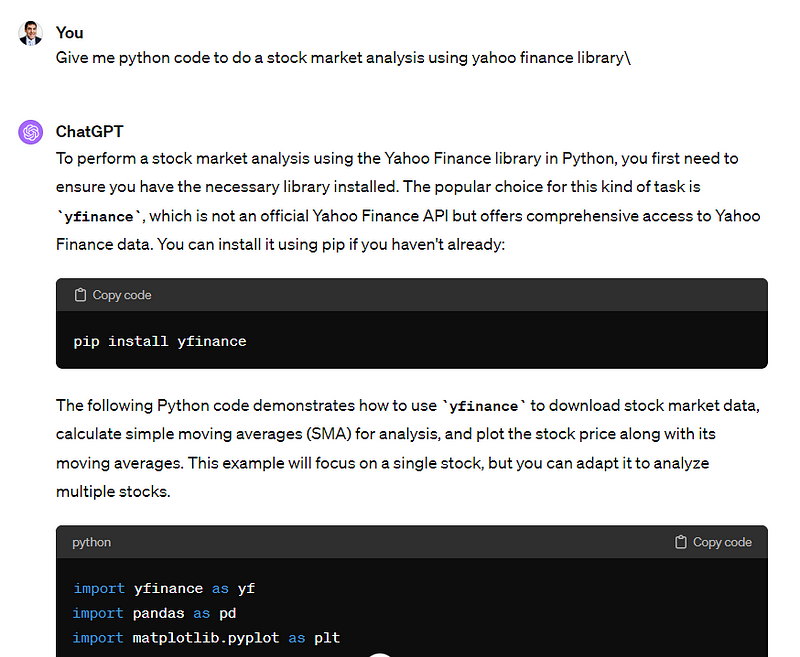

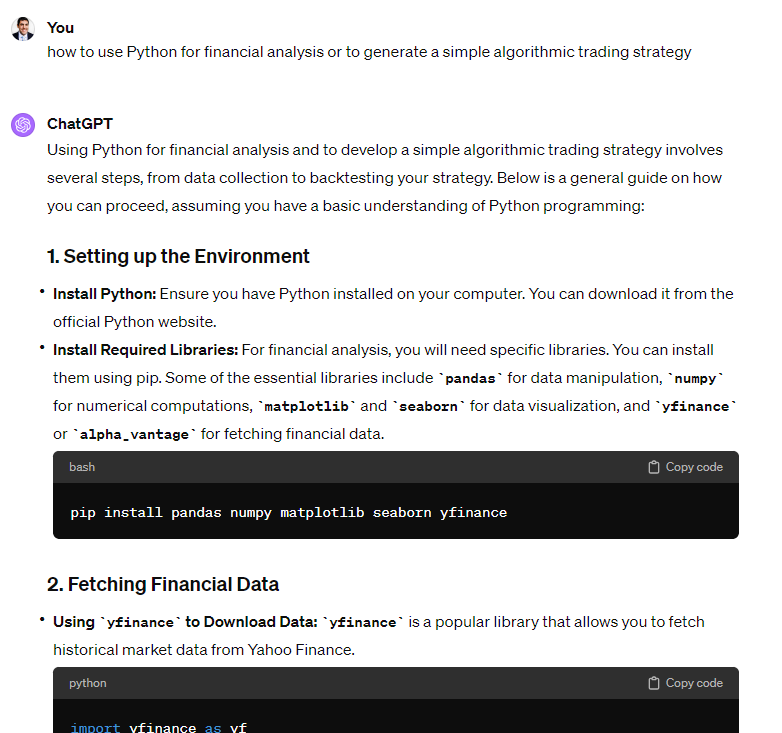

For instance, you might ask how to use Python for financial analysis or to generate a simple algorithmic trading strategy.

This interactive learning process is akin to having a personal tutor, allowing you to explore topics at your own pace.

This is the code it give me with the first prompt for example.

import yfinance as yf

import pandas as pd

import matplotlib.pyplot as plt

# Fetch historical data for a stock

ticker = 'AAPL'

start_date = '2020-01-01'

end_date = '2023-01-01'

data = yf.download(ticker, start=start_date, end=end_date)

# Calculate the 50-day Simple Moving Average (SMA)

data['50_MA'] = data['Close'].rolling(window=50).mean()

# Define a simple strategy: buy when Close > 50_MA, sell when Close < 50_MA

data['Signal'] = 0

data['Signal'][data['Close'] > data['50_MA']] = 1

data['Position'] = data['Signal'].diff()

# Plotting the strategy

plt.figure(figsize=(14, 7))

plt.plot(data['Close'], label=f'{ticker} Close Price', alpha=0.5)

plt.plot(data['50_MA'], label='50-Day SMA', alpha=0.75)

plt.scatter(data.index[data['Position'] == 1], data['Close'][data['Position'] == 1], label='Buy', marker='^', color='g', alpha=1)

plt.scatter(data.index[data['Position'] == -1], data['Close'][data['Position'] == -1], label='Sell', marker='v', color='r', alpha=1)

plt.title(f'{ticker} Close Price and 50-Day SMA\nSimple Trading Strategy')

plt.legend()

plt.show()Try it and this would be the output:

Tip: You can repeat this analysis for any stock, just change the ticker = ‘AAPL’ to ticker = ‘TSLA’ for example:

This is the “new code”:

import yfinance as yf

import pandas as pd

import matplotlib.pyplot as plt

# Fetch historical data for a stock

ticker = 'TSLA'

start_date = '2020-01-01'

end_date = '2023-01-01'

data = yf.download(ticker, start=start_date, end=end_date)

# Calculate the 50-day Simple Moving Average (SMA)

data['50_MA'] = data['Close'].rolling(window=50).mean()

# Define a simple strategy: buy when Close > 50_MA, sell when Close < 50_MA

data['Signal'] = 0

data['Signal'][data['Close'] > data['50_MA']] = 1

data['Position'] = data['Signal'].diff()

# Plotting the strategy

plt.figure(figsize=(14, 7))

plt.plot(data['Close'], label=f'{ticker} Close Price', alpha=0.5)

plt.plot(data['50_MA'], label='50-Day SMA', alpha=0.75)

plt.scatter(data.index[data['Position'] == 1], data['Close'][data['Position'] == 1], label='Buy', marker='^', color='g', alpha=1)

plt.scatter(data.index[data['Position'] == -1], data['Close'][data['Position'] == -1], label='Sell', marker='v', color='r', alpha=1)

plt.title(f'{ticker} Close Price and 50-Day SMA\nSimple Trading Strategy')

plt.legend()

plt.show()Stay Updated on Trends

The financial markets are constantly evolving, with new technologies and methodologies emerging regularly.

Use ChatGPT to stay informed about the latest trends in data-driven investing.

Whether it’s the impact of blockchain on financial markets or the latest in high-frequency trading, ChatGPT can provide summaries and explanations of current trends.

You can even create a GPT for this.

Practical Applications

Theory is crucial, but practice makes perfect. Ask ChatGPT for practical exercises, data sources, and project ideas to apply what you’ve learned.

Whether it’s analyzing stock market data, creating predictive models, or backtesting trading strategies, ChatGPT can guide you through the process, suggest resources, and even help debug your code.

And it will answer with the reason and new code!

Bridging the Gap to Expertise

As you become more comfortable with data-driven investing concepts, use ChatGPT to explore specialized areas of interest.

This could include deep dives into predictive analytics, ESG investing, or the nuances of behavioral finance.

ChatGPT can help you explore academic papers, find online courses, and connect you with expert communities in your area of interest.

Visit us at DataDrivenInvestor.com

Subscribe to DDIntel here.

Have a unique story to share? Submit to DDIntel here.

Join our creator ecosystem here.

DDIntel captures the more notable pieces from our main site and our popular DDI Medium publication. Check us out for more insightful work from our community.

DDI Official Telegram Channel: https://t.me/+tafUp6ecEys4YjQ1