How I Earn $6,000/mo with Semi-Automated Crypto Trading — Part 2

Martingale Trading Bot Theory 101

Martingale bots are a little complex, but once you understand them, you’ll see why I love them so much.

This blog is available in video form at the bottom of the text.

I’ve had a few questions come in as well as a couple of people try to offer me money to build them a bot.

I don’t want to take on the risk of your money.

I don’t want to act like I know too much about what I’m doing.

I think it’s better that I just deep dive to explain how I’m using these bots, and my rationale when configuring them.

If you didn’t read the first blog on this topic, you can find it here: How I Earn $6,000/mo from with Semi-Automated Crypto Trading on my Mobile Device

So let me elaborate.

A lot of the ideas I’m going to put forth here come from a bubble — me.

At the time when I made my original videos that I have trascripted into these blogs (circa April 2023) — I haven’t really taken any formal trading classes. I’ve just broken things down the way I see them.

Maybe it’ll help some of you.

Let me re-iterate that I’m not offering financial advice.

I’m just sharing what works for me.

In this blog I’m going to go full elementary mode. Because that’s kind of where I am too, even though I am seeing great results.

Swing Theory

I’m only just now learning about that myself.

Very, very interesting stuff, but we’re gonna keep it simple and I’m just going to show very basic graphs with very simple visuals to give an idea of how you might want to set up your bot and how you would change settings when the market changes conditions.

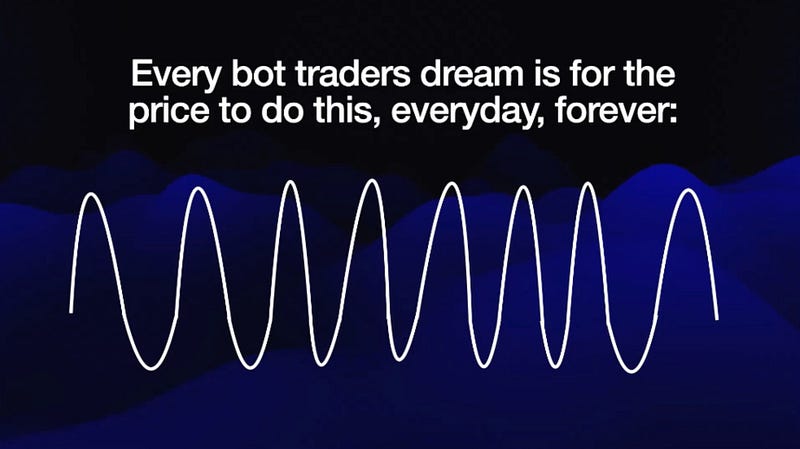

We want some volatility because that’s how we make money…. but we want it to be predictable.

This is pretty much what everyone wants.

Unfortunately, we can desire that all we want…..

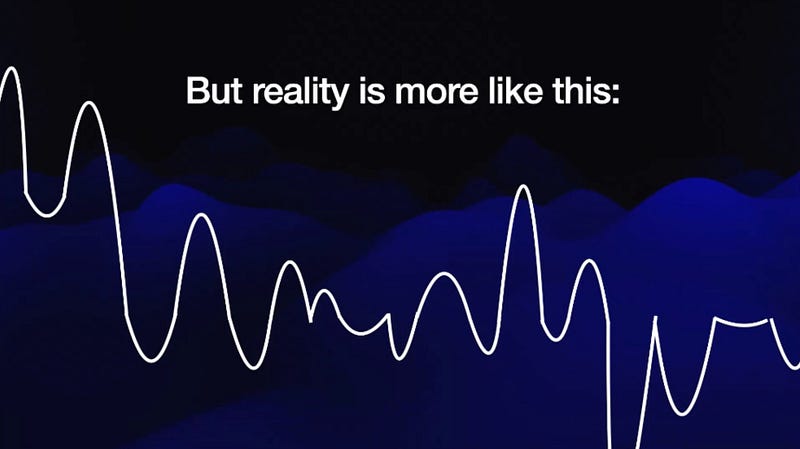

There are some exceptions, of course.

So let’s get into how you would best set up your bot to kind of control for some of these fluctuations and dips, things like that.

There are four different types of market conditions when examining price action.

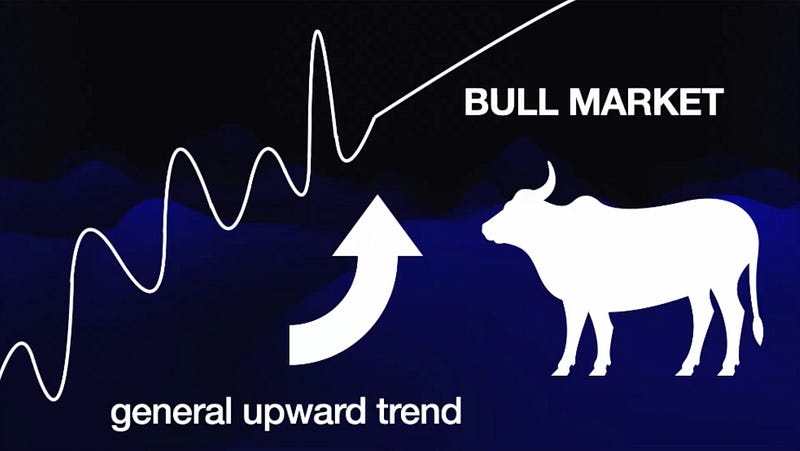

1. Bull Market

Prices are going up!

The market is on the move and everyone is excited.

2. Bear Market

The market is making newbies cry.

A bear market is a general downward trend and when I say general downward trend or general upward I mean sustained over a period of time that justifies calling it a new market.

Just because it falls for a day or two doesn’t necessarily mean you’ve entered a totally new market condition — so be careful there — but it is important to understand that you have upward action, downward action, then we have the states of market condition — Flat action where the price is relatively stable, and Volatile action

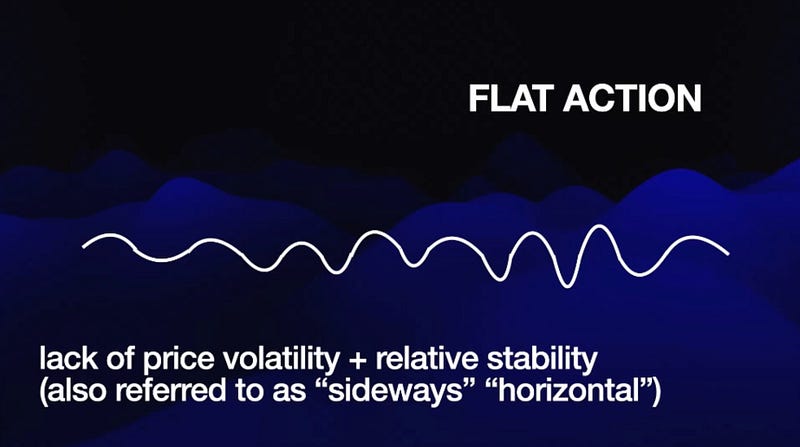

3. Flat Action

Some people call this sideways or horizontal action, just meaning that over time it doesn’t shoot up or down.

It remains relatively flat.

4. Volatile Action

Then we have volatile action and it is easy to see price bouncing around all over the place.

The Martingale bot works best in Bullish market that is also Volatile.

I’m definately having the best results with them, in terms of overall profit.

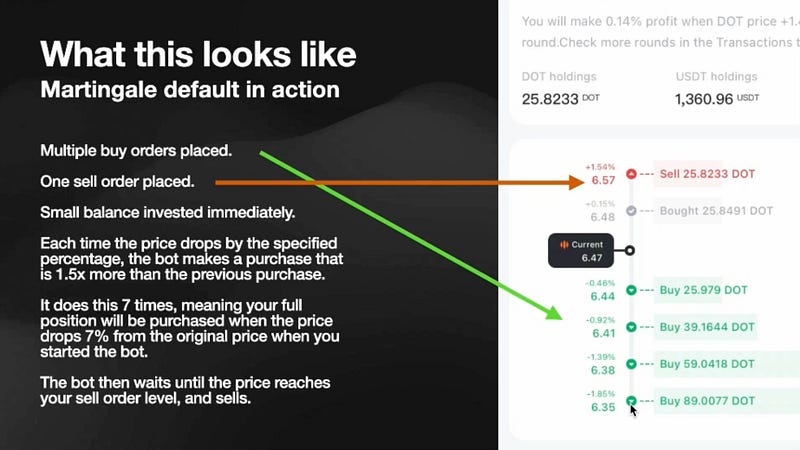

A Martingale is a method where the bot does a descending incremental buy-in, so it anticipates there being a dip.

The bot needs some volatile price swing to really net bigger profits, but it will incrementally buy-in with increased amounts as the price drops, spreading risk over a dip.

Martingale eventually loads up your full balance if the price dip is large enough, and then when it crosses your profit take %, it sells off all at once.

This is different than Spot Grids or Infinity Grids or some of the other bots that will issue multiple buy sell orders all over the place, for smaller amounts.

A Martingale bot includes an all-at-once sell order.

I like this because I can take bigger profits and the way I’m doing it I’m just earning more money this way than I have with any of the other bots I’ve tested.

The Infinity Grid bots and others will still usually profit, but often more like 5–30% APR.

(If you are running Grid bots and having better results, I’d love to know! Leave a Comment!”)

I am seeing 250% with Martingales and my “See 100, Take $100” strategy.

So that’s why I’m sticking with them.

Other people might have better results with other bots.

Each market condition will work better with different bot settings.

My bot settings :

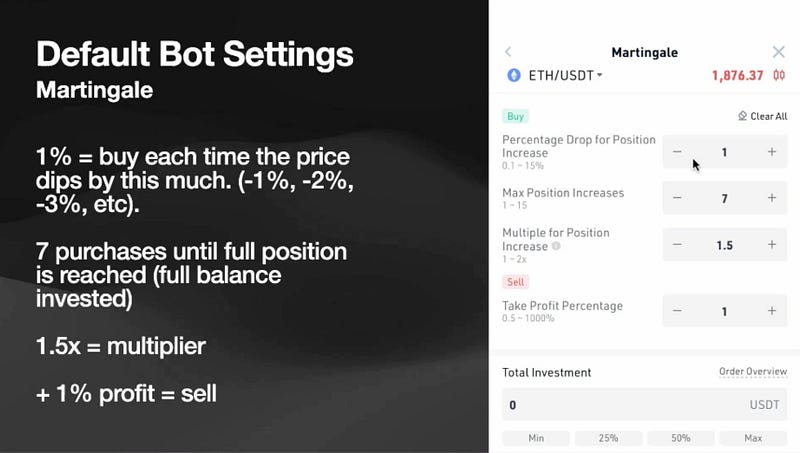

The default automatic settings in KuCoin are

Percentage Drop for Position Increase = 1 %. This means that every time the price drops by 1 %, then it’s going to buy more and it will increase your position. (This is called “Price Scale” in Pionex)

Max increases = 7. This means it’s going to buy a maximum of seven times.

Multiple for Position Increase = 1.5. This is the multiplier. The bot is going to make its first buy, then increase each subsequent buy by 1.5x until it invests your full balance at the 7th buy. (This is called Volume Scale in Pionex)

The Not-So-Obvious Math of the Multiplier

If you change Multiple for Position Increase (KuCoin), or Volume Scale (in Pionex), it might not be obvious, but let’s say you enter 2 instead of 1.5.

I did that at first thinking that doubling my balance every time would lead to faster investment of the full balance.

True, but also :

This makes the first initial buy-ins much smaller, because mathematically, if the bot is having to double every time to get to your seventh buy, the first few buys are not even worth your time. You will be trading on pennies, or fractions of pennies.

So, I leave Max Position Increase / Volume Scale at default.

I don’t really go lower on the Max Position Increase / Volume Scale, but some people do.

Default settings are usually meant to be safer

The default settings in KuCoin are configured to be safer, and in general less risky.

Less risk = less reward.

In Pionex — the bot is precongifured with “AI Settings”, which means it takes a look at the recent moving averages and adjusts the settings accordingly.

However, it only does this when you start the bot. It does not dynamically adjust settings while the bot is running. Important!

We’ve dropped by a good 10 % as we go into the weekend, so I will actually switch my bot over to something more like this the default setting (what I call a “Wider Spread”) because I’m anticipating a price drop to actually get into my full position and then on Monday or whenever the the market starts to rise again, the bot will eventually hit the sell point (or I’ll help it by stopping the bot when I hit $100 in the green)

Getting my Squeeze on

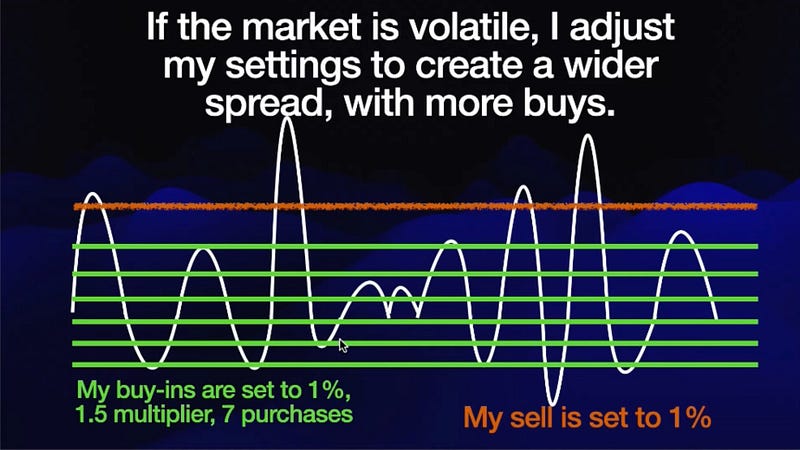

When I say “squeeze my settings”, what I do here when the market is flatter, I actually change my settings to function in a smaller range.

When the market is flatter, I might go with something more like 0.3% Percentage Drop for Position Increase and instead of 1% Take Profit percentage, I might go with 0 .6, something like that.

And that has the effect of squeezing the range at which I’m trading to accommodate the smaller fluctuations that are happening.

When I expect a drop to happen (or if it’s just generally more volatile), I will leave these settings and sometimes I might even expand further. I might increase to 9 buys.

If I’m expecting the market to dip significantly, I might even set Percentage Drop / Price Scale to 2%, where it’s not going to do buy -ins until it falls 2%.

How would I anticipate this?

Lots of different factors, but sometimes when you know something’s coming, it’s a best to adjust your settings accordingly. This can be market news, insider knowledge, etc.

Take Away : I squeeze my bot settings when we have flat market action, and I expand them when we have more volatile action.

Very basic idea.

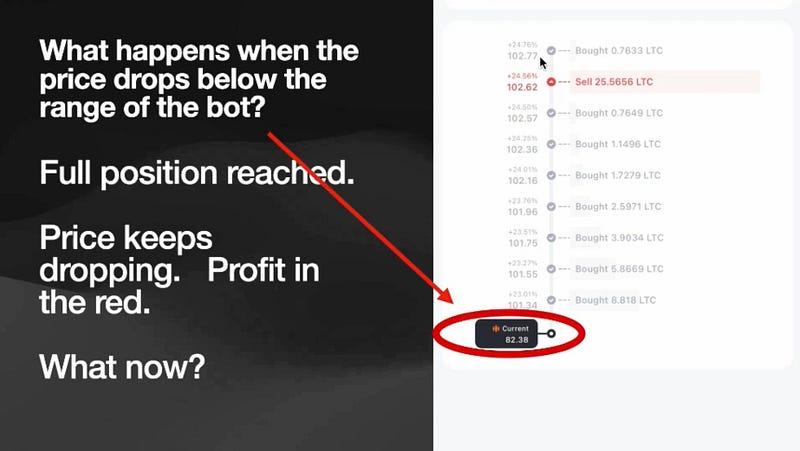

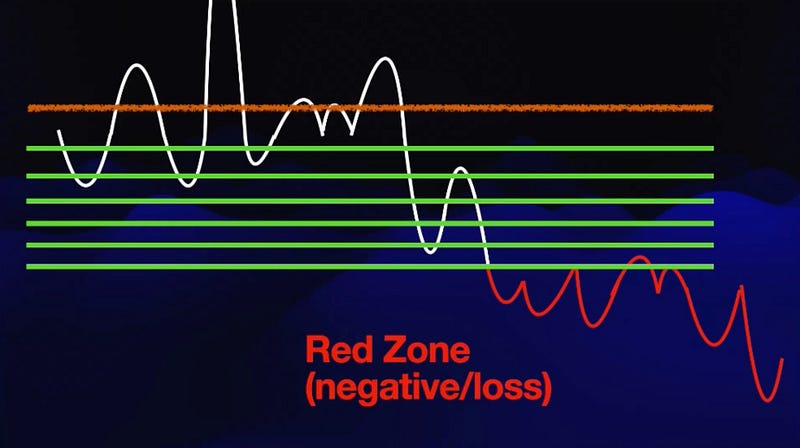

Going into the Red

Next, what happens when the price does this?

What happens when all of a sudden price dips and now your bot’s in the red?

Well what’s going to happen is the bot is stuck, unable to execute any sales until the price swings back up to the sell order price OR — if you set a stop loss it will reach your accepted toleration and sell for a loss.

I do not run Martingale bots on any coin that I am not sure of the future of.

There are lots of coins that people are really behind and they have a great presence, even though they may or may not last.

I would never run a bot without a stop loss on less widely adopted coins, just in case.

My stop-loss default is 10 % meaning if I invest a thousand the price actually drops and the value is $900 The bot will close sell out and then I can restart it.

******If I’m going to have to be away and not be able to pay attention to my bots, then I will put out a stop loss and I do that just so as soon as I get back with my bot and get back in action I can usually recoup that 10 % within half a month sometimes less than that.*****

UPDATE : The above italic paragraph is old info. I no longer do this. My strategy changed. When I need to stop paying attention to my bots — I simply make my spread so wide that I don’t worry.

Example : Price Scale — 1%, Profit Take-2%, 15 buys. This will spread my risk over a 15% price drop.

Becoming Unstuck

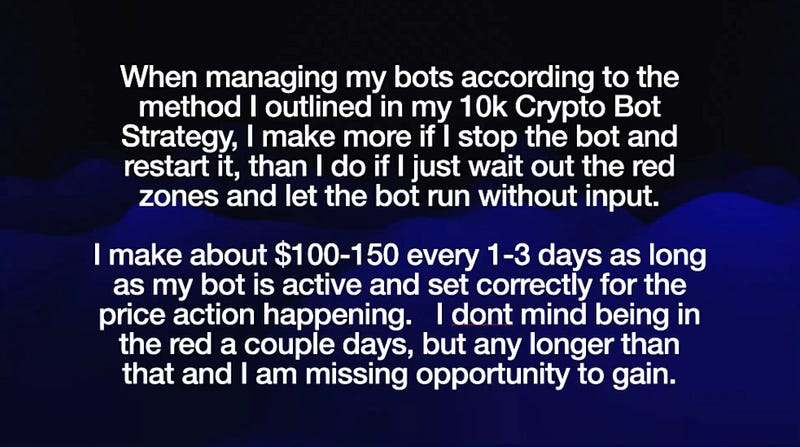

If the bot is stuck in the red for two days straight — that’s when I take the loss and start it again it’s just more profitable over time doing it that way. I try to slam stop manually when I reach -$150. I try not to let it go too far below that.

If I don’t manually stop/start the bot — sometimes I’ll be in the red for weeks, sometimes it won’t return to the same price range anytime soon, and if you wait too long you’re just missing the opportunity for trading.

That is the way that I look at it.

The Limbo Zone

So we’ve talked about what happens when the bot goes into the red when it starts dipping below the price range when you’re in, but what happens when it does the opposite?

I call this the limbo zone. Your bot can still end up stuck if it sells out of your position, and now it’s waiting for a dip before it does another buy, but ….the market doesn’t dip!

Now it just keeps on going up, only moving with your first buy — and now the market exists in a different price range, and your bot is stuck for a whole new reason.

It’s profitable, it’s in the green, but you might only collect pennies for a while if it’s only selling your first buy-in, over and over.

This is another situation where you’re going to want to stop your bot, and reconfigure it.

Just so you know, this graphic is more like what you should expect in the market >>>

When you zoom out a little bit and you look over the course of weeks and months, you see that there will be different price plateaus that happen over time.

When it shoots up, price usually spikes, then the market plateaus shortly after.

That is a really bad graphic on my part — but what I really want you to see in this graphic is that — for each of these different relative price plateaus I will have stopped my bot, and restarted it so that it can function within the new price fluctuation range.

If I anticipate a big swing upward — let’s say it just keeps going up and my bot is stuck, sometimes I will close the bot and then I immediately buy the coin and then I just hold it and I ride that wave, OR — set to a wider spread.

A wider spread works for unexpected dips….. or unexpected bull runs.

But it’s not always the best option.

Let’s say I see Ethereum is going into a whole different range and I’m sitting there watching through the day and it’s like, 2100 2200 2300 — the smartest thing to do there is not to enable the bot, but to just buy the coin hold it and set a limit order.

The reason — a wider spread doesn’t mean the market will dip to invest your more of your balance.

Different types of Bulls

Bullish upward movement is not the same thing as Bullish Volatility.

Bullish Upward Movement = the market is just going up and up and up.

Bullish Volatility = the market is going up, and up, but also, zig zagging up and down as it goes.

Volatility is what the bot thrives on.

Less volatility = squeeze the settings to a thinner spread.

More volatility = expand the settings to a wider spread.

Is this starting to make sense now? I hope so.

Let me know in the comments, I’d love to help.

That’s it — that’s the basics of how to adjust these bots for different price fluctuations — you will squeeze or expand the bot settings and then you stop and restart the bot in different price ranges.

One day hopefully I will be able to code a custom bot that automatically does this work for me — dynamically adjust settings based on moving averages.

If if you have found something like that, or have built it — and are willing to share — shoot me a message, I’d love to learn about it.

I hope this helps everyone!

Onward and upward fellas, ladies and gentlemen and everybody in between.

Peace out!

Here is the video version of this blog :

🖥️ My Pionex (USA) referral link : https://www.pionex.us/sign/ref/Nlyjd7Fh referral code = Nlyjd7Fh

Thank you for reading!

If you enjoyed, here are three ways you can help me out:

- Drop me a follow → Automated Income Lifestyle

- Leave an appreciation and a comment if you enjoyed

- Receive an e-mail every time I post on Medium → Click Here

Until next time….

Onward and Upward Everybody!

-Chris

#crypto #cryptotrader #cryptotradingbot #cryptocurrency #investing #automation #onlineincome #funfacts #ai #desktop #martingale #automated #pionex #exchangetraded